Irina Fedorova / iStock Editorial via Getty Images

Since the collapse of companies like Celsius (CEL-USD), BlockFi, and FTX (FTT-USD) last year, there has been a greater suspicion of centralized crypto custodians and exchanges. Much of that skepticism is perhaps appropriately focused on Binance (BNB-USD). From where I sit, any exchange that has a native token is one that should be given a little extra scrutiny due to the possibility that these companies can sometimes be exposed to more than their own token supply.

In this article, we will look at a crypto exchange called OKX (OKB-USD). We will explore the makeup of the exchange reserve and assess the toconomics of OKB Utility Coin.

What is OKX?

OKX is a cryptocurrency company that has gone through some changes in recent years. The company was previously based in Beijing, China, but has since re-located to Seychelles. In addition to relocating the headquarters, the company rebranded from “OKX” to “OKX” in 2022. The company operates a centralized exchange and derivatives platform that is typically among the top 10 in 24-hour volume and has 9 million monthly visits, according to Data. From CoinGecko.

Beyond spot and derivative crypto offerings, OKX also operates a crowdfunding product called “Jumpstart”, which has raised over $283 billion in startup funds through things like IEOs or Initial Exchange Offerings. Notable IEOs that have gone through this process on OKX include Toncoin (TON-USD) and the recently launched SUI Blockchain (SUI-USD). Like many other centralized and decentralized crypto exchanges, OKEx has a native utility coin that essentially serves as a blockchain-based rewards program for users of the exchange.

OKB Utility (OKX.com)

With OKB, token holders can generate passive income yield as well as a discount on trading fees within the OKEx ecosystem. The more OKB users hold in their accounts, the better the discount on those fees.

Token Supply and Display

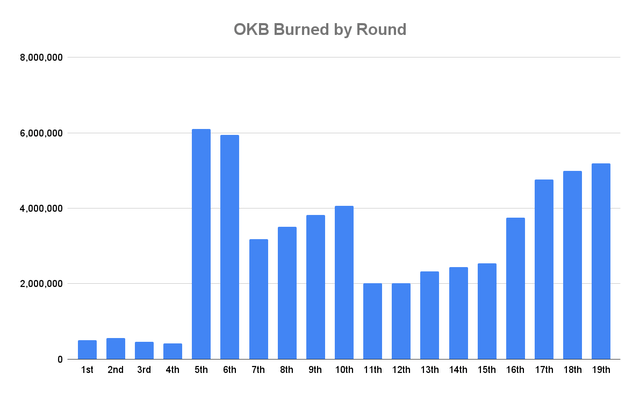

From a supply perspective, there are 300 million OKB coins with 60 million in circulation. About 59 million native coins have been bought back by OKEx through the “Buy Back and Burn” program that began in 2019:

OKB round by burn (OKX)

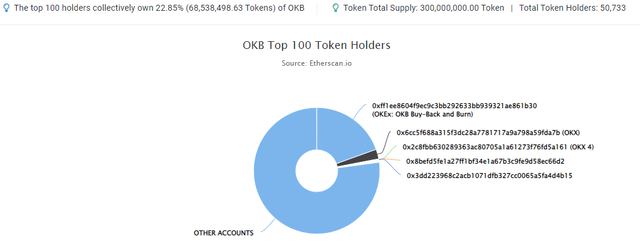

The first round of token burning took place in May 2019 and the most recent 19th round ended in February this year. The Buy Back and Burn wallet address accounts for approximately 19.5% of the total OKB and is by far the largest single wallet address holder:

OKB Distribution (Etherscan)

The next two largest OKB holders are two separate OKX wallets that hold only 2.7% of the OKB outstanding combined. The remaining tokens are very well distributed among over 50k additional ETH wallet addresses. The top 100 token holders only control 22.9% of the outstanding OKB – and again, one of those addresses is a burn address.

- Coin Value: $44.05

- Coin Supply: 300 million

- Fully Diluted Cap: $13.3 billion

- Totally Tapered Cap Rank: #8

From a purely diluted market cap perspective, OKB has quietly become a top 10 crypto coin and has significantly outperformed all other exchange tokens over the past 12 months:

1 Year Performance (Seeking Alpha)

While other exchange coins have diverged, often in response to the collapse of exchanges, OKB is up 177% over the past year and only 24% below the coin’s high of $58.46.

okex proof of reserve

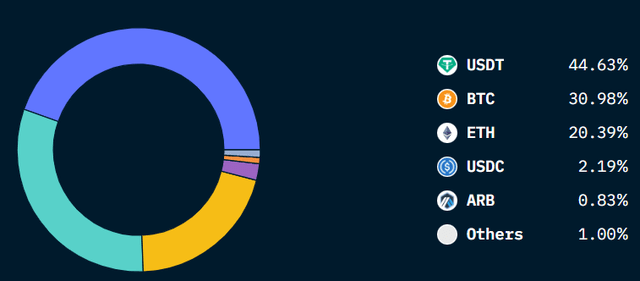

By itself, creating an exchange token like OKB doesn’t cause problems for an exchange. When FTX collapsed last year, a major issue was the fact that a related party was holding FTX’s exchange tokens as collateral. Not so with OKX, as evidenced by repository data via Nansen:

OKX Proof of Reserve (Nansen)

Nansen cites $9.9 billion in proof of assets reserved on known OKEx wallets. Of that $9.9 billion, 44.6% is held in Tether (USDT-USD), 31% is held in Bitcoin (BTC-USD) and over 20% is held in Ethereum (ETH-USD). The remaining token allocation is spread between USD Coin (USDC-USD), Arbitrum’s Governance Token (ARB-USD), and a handful of other smaller coins. The security of something like Tether can certainly be debated and has been for years. But beyond that the OKX proof of the repository is very clear.

|

Post |

site |

btc balance |

change 24 hours |

30d transformation |

|---|---|---|---|---|

| 1 |

coinbase |

486,644.31 |

-307.82 |

+3,871.32 |

| 2 |

binance |

395,945.02 |

-183,580.92 |

-149,323.24 |

| 3 |

bitfinex |

355,467.69 |

-1,766.56 |

+1,925.51 |

| 4 |

okx |

118,903.02 |

-327.21 |

-3,432.44 |

| 5 |

Gemini |

92,523.71 |

+215.02 |

-12,365.24 |

Click to enlarge

Source: CoinGlass, as of 5/8/23

OKX has the fourth largest BTC position of any centralized exchange according to CoinGlass and more than half of the company’s reserves are held in high-quality blue chip cryptos like bitcoin and ethereum.

risk

As an exchange coin, there are many risks involved in going long on something like OKB. Firstly, holders are incentivized to hold tokens in order to get better rates on products and services. When an exchange is growing its user base and gaining market share, it has a phenomenal positive feedback loop. If OKX users churn or if the incentives no longer justify holding OKB tokens, the coin’s price could drop very quickly.

This is a major issue with the change in exchange token model and platform incentive structure, which we saw last year with Crypto.com’s Cronos (CRO-USD) exchange token. That coin has lost about 80% of its value since I wrote about it after a change in incentive structure.

Summary

Exchange tokens can be fun in crypto because buying them is a bit like betting on the success of exchanges. They act like non-dividend paying growth stocks in that regard. Especially if the token also grants platform voting rights of some sort. While most of these exchange tokens have small variations on what utility is provided to the user within the platform, the fundamental commonality between them all is that buying them is betting on the success of the platform.

In that regard, it is important to assess the sustainability of platform development, proof of reserves and TAM of the business. For OKEx, a major part of the volume comes from derivatives trading. This is not something that US-based crypto buyers currently have access to. This could theoretically limit the future demand for the OKB token. However, the buyback and burn program has clearly helped propel the coin’s price upwards. While I don’t personally hold OKB, in my view there are worse coins for the long run in the crypto ecosystem.

Editor’s Note: This article features one or more microcap stocks. Please be aware of the risks associated with these shares.

source: seekingalpha.com