happyphoton/iStock via Getty Images

In times of uncertainty when the stock market is volatile, it is important to hedge, especially if you are not all in cash. Now, a commonly heard rhetoric is to invest in gold, but, contrary to the trend, this thesis aims to assess whether it is not Bitcoin (BTC-USD) that you should choose.

For this purpose, the Valkyrie Bitcoin Strategy ETF (NASDAQ: BTF) provides exposure to bitcoin futures. As I’ll detail later, but a look at the price action shows it’s up 60% since the start of 2023. produced above.

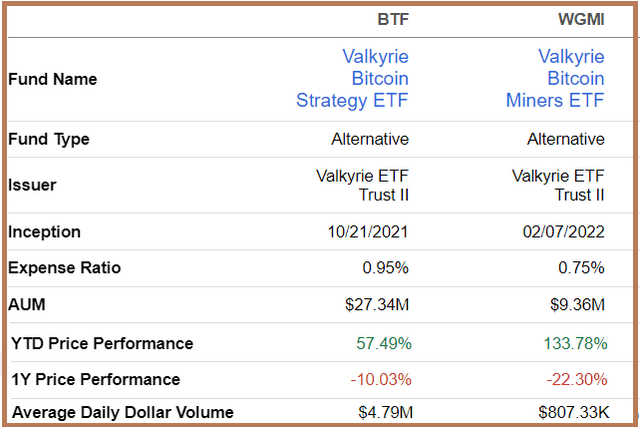

BTF Key Metrics (www.seekingalpha.com)

This double-digit price performance of over 50% may seem like something to do during current market conditions where volatility reigns, while at the same time, comparisons with other asset classes, including gold, help put things into perspective. Does

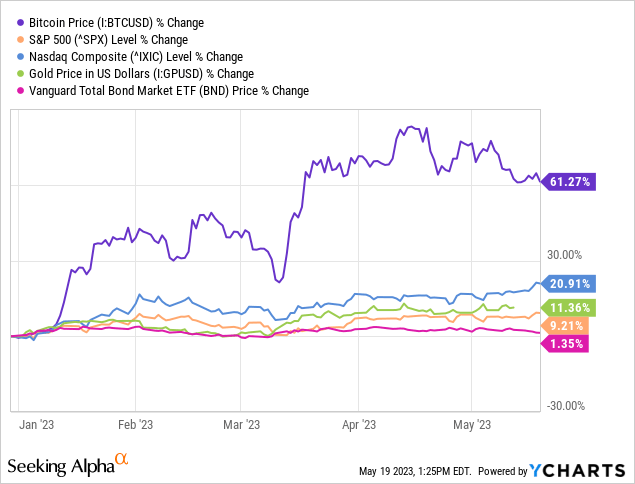

bitcoin is beating everyone including gold

The chart below shows that bitcoin has outperformed all other asset classes, be it bonds, gold, the Nasdaq Composite, as well as the S&P 500.

by data YCharts

by data YCharts

Taking a closer look, while bitcoin first started out outperforming the S&P 500, the level of outperformance peaked as early as March, which Chance With the beginning of the banking turmoil. It also outperformed the Nasdaq Composite Index, which, as shown above, is skewed toward mega-cap tech growth stocks by nearly 40%. Thus, digital currency, which by the way, is a product of blockchain technology and was more correlated with technology in 2022, now outperforms the technology sector by a huge margin.

The reason for bitcoin’s strength may be that with the banking turmoil, some investors have begun to view crypto as a true asset class, not belonging to others, even US government bonds. Too. Remarkably, it is these bonds, especially long-term Treasuries, that are considered risk-free but partially blamed for To the distress of the banks as they were suffering from devaluation due to rising interest rates. Now, since troubled regional banks held a lot of these, the value of their assets has plummeted, in turn causing liquidity problems, and apparently, as few had predicted, the interest rate risk. Cracks will be visible on the liquidity front through US Treasuries.

As a result, bitcoin was not the reason for the bank run.

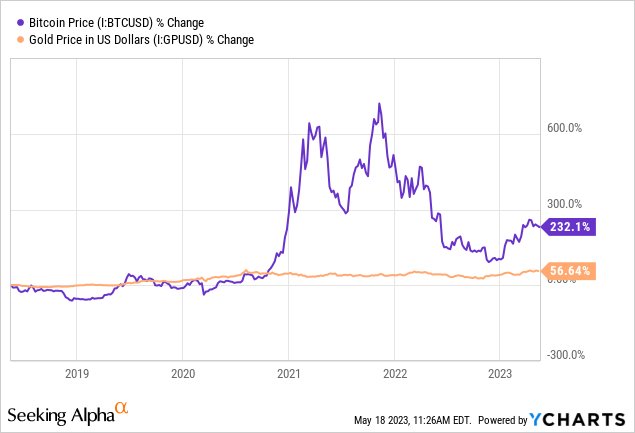

Along with the bank troubles, High The debt-to-GDP ratio has come into focus as a result of the need to raise the debt ceiling, causing some to have doubts about the financial system itself, which brings us to the core of crypto which was fine revolutionary change financial system. Thus, some investors found solace in the digital currency, as in parallel gold failed to rise parabolically as had been predicted. Some From 2021 onwards. In contrast, it was the digital currency that prevailed despite being more volatile as illustrated below, posting gains of over 232% over the five-year period.

by data YCharts

by data YCharts

Significantly, despite a major loss of confidence since November last year with the advent of FTX, gold is still underperforming the digital currency. collapse, which was a crypto exchange platform headed by Sam Bankman-Fried. This prompted many investors to sell as the price of bitcoin fell sharply and touched $15.4K LevelThe market cap dropped to a low not seen since May 2020 to around $305 billion.

Thus, crypto is not without risk.

volatility risk

Here, few will remember systemic risks or risks associated with the demise of the crypto ecosystem as a whole. ProduceAnd others began with the FTX implosion, which caused the crypto lending and brokerage firm to suspend lenders’ ability to withdraw their crypto.

As a result, there could also be a domino effect affecting stakeholders as companies involved in crypto-related transactions face a more challenging regulatory environment as the FTX crash and banking turmoil gave the Security and Exchange Commission the perfect excuse to swoop in. given, as a result of which market makers such as Jane Street and Jump are planning to shift Their activities are offshored to more crypto-friendly jurisdictions. In addition, the Commodities Futures Trading Commission (CFTC) filed trial Against the crypto exchange, Binance (BNB-USD), for offering some derivatives products.

Liquidity conditions for smaller exchanges also worsened in the wake of the banking turmoil, in addition to regulatory actions, notably the demise of SilverGate Capital (OTC:SICP) and the closure of its SEN (SilverGate Exchange Network) and others Is. Dollar exchange for bitcoin.

Case for investing in BTF

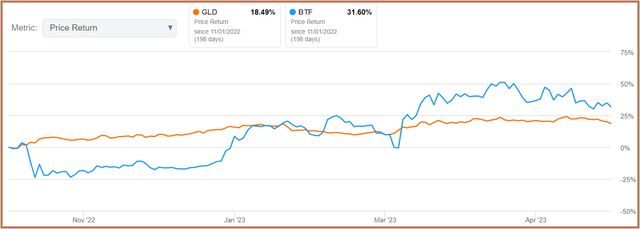

Despite all these sufferings, more people are attracted to BTF, as shown in the chart below, which spans from November to May, a period that includes the FTX episode and its contagion effects and the banks’ problems . During this time, the Bitcoin ETF has been highly volatile and, at times, underperformed the SPDR Gold Shares ETF (GLD), but eventually gained the upper hand by providing a gain of 31.6% for those (blue chart below). Brave enough to wear it.

Price Performance Comparison: BTF and GLD (seekingalpha.com)

Now, this is all based on historical performances and no one knows what the future will look like, but the facts definitely demand a rethink in the hedging strategy.

This doesn’t mean investors have to get rid of gold, which has proven itself over the centuries as a valuable store of value, but more to diversify into bitcoin, which, it should be mentioned, is banking on The Fed’s actions also provided some support. crisis. In this regard, the tools put in place by the US central bank to ease monetary conditions show that even if the Fed keeps rates at current levels, it will inject liquidity into the system to avoid further cracks.

Beyond that, there are many ways to get exposure to crypto, including buying stock of miners or companies that use blockchain technology to produce bitcoin. For this purpose, there is the Valkyrie Bitcoin Miners ETF (WGMI) with a low expense ratio of 0.75%. The problem, however, is that it is more volatile, as can be seen from the divergence between its year-to-date and one-year price performance. Furthermore, it has just under $10M in assets under management, with an average daily volume traded of around $807K. This can lead to poor liquidity and wide spreads (the difference between the bid and ask prices), especially if the market is highly volatile, and you will need to exit your positions quickly.

Comparison of BTF and WGMI (seekingalpha.com)

Others may have bitcoin trading or shares of companies in crypto exchanges, but as I mentioned earlier, these are not immune to further regulatory risks.

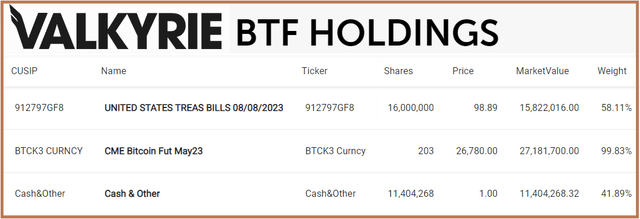

Going forward, there are bitcoin futures, similar to oil futures contracts, that allow traders to bet on future prices without actually owning a barrel of crude oil. For this purpose, Valkyrie’s BTF holds The CME Bitcoin futures for May 2023 are as shown below, and come with an expense ratio of 0.95%.

BTF Holdings (valkyrie-funds.com)

Bitcoin futures are closely regulated by the CFTC, as for any type of commodity, in assessing the risks of owning a BTF, and thus do not involve the same types of liquidity risks that affect exchanges. where investors’ dollars are to be converted into bitcoin and vice versa. Instead, the volatility of the ETF’s stock depends on the price of the commodity, in this case, bitcoin.

hedging for uncertainty

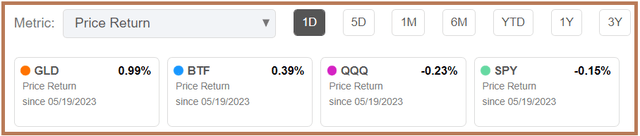

Looking at price action, both GLD and BTF were up on Friday, May 19 as the tussle between Democrats and Republicans over debt ceiling expansion continued, while both the S&P 500 and the Nasdaq were down as pictured.

The Price Action (www.seekingalpha.com)

Here, in addition to fueling appetite for hedging in addition to the risks of a United States default, a high debt-to-GDP ratio leads to higher payments in the form of interest payments and is therefore inflationary in nature, and bitcoin and gold supports both. However, price action has evolved in favor of the S&P 500 and Nasdaq on Monday, May 22, showing a willingness on both sides of the aisle to come to a consensus. However, with June 1st With the deadline approaching and keeping in mind that negotiations normally last until the last minute, there could be further uncertainty on the side of both gold and bitcoin.

According to the price target, BTF could climb to the level of $11.3 (10.4 x 1.084) based on its one-year decline of 8.4% and the current share price of $10.4. I support my bullish stance with an RSI of 45, which does not indicate overbought conditions. Also, this is a medium target, as most of the growth during the banking turmoil may be behind us, but, with a Fed pause likely in June or the second half of this year, monetary conditions should ease further . This bodes well for equities in general, including bitcoin miners and traders, which leads to more demand for the digital currency.

Finally, through comparisons with other asset classes, including gold, this thesis shows that despite all its suffering, bitcoin has delivered superior returns, which cannot be ignored during these highly uncertain times, even though Don’t be a crypto enthusiast. Finishing with a few words of caution, keep in mind that I haven’t talked about bitcoin gaining safe haven status and replacing gold, as this is a relatively recent development that has yet to stand the test of time. Have to live up to it.

Editor’s Note: This article discusses one or more securities that do not trade on a major US exchange. Please be aware of the risks associated with these shares.

source: seekingalpha.com