Charde Paine / E+ via Getty Images

Cipher Mining Inc. (NASDAQ: CIFR) is building mining capacity at an impressive rate; It has signed an excellent power purchase agreement (PPA) with Luminant which gives it a competitive advantage over all the miners I follow except Riot Platforms (RIOT) and a profitable bitcoin on all bitcoin prices for the last three (BTC-USD) guarantees operations. Year. The PPA has the flexibility to allow Cipher to sell the electricity purchased under the agreement back to the grid when the cost of electricity makes it more profitable than bitcoin mining. Selling electricity last quarter, it added $150k to profit.

Cipher has signed an equally impressive agreement with Canaan (CAN) for 11,000 new miners that will be activated in Q3 and implied in a recent earnings call that it is offering Cipher preferential purchase prices and payment terms in an expanded part of the agreement.

Management is delivering growth while reducing debt and dilution, seeking to build a true industry leader. Listening to the recent earnings call, it was clear that they believe they are already the industry leader and are on the right track. They see no barriers and are moving forward with energy and speed.

They have their heads down, working hard, following the plan. If they look up, they may see something negative on the horizon, potentially seriously disrupting their plans.

This is the third article I have written on bitcoin miners in recent weeks. They have experienced a jump in prices that started in December and is continuing. Initially, Cipher was leading the pack, but as you can see from the dashboard below, they have recently pulled back. This article will explain the reason for the initial rise and present an argument for the downturn.

Performance of mining companies (May 10) (author database)

in the latest earnings callI was looking for information on two things (Q1 2023, May 9)

- How is the capacity building going?

- What’s up with the Luminant legal case?

cipher capability creation

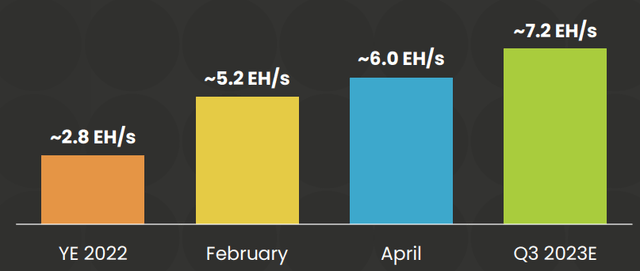

Cipher is growing rapidly; They’re doing a great job (Slide 7 of Q1 2023) earnings call presentation,

Cipher Capacity (Q1 2023 Earnings)

7.2EH/s makes Cipher a real player in this market. Riot Platforms quotes a current figure of 9.8 and a target of 11.

I listened with interest to how well the construction was going; I heard management say “the best of the best” when they said that it was enough time for me to start counting. I was impressed by the quoted bitcoin mining performance, 45 in two days (May 7th and May 8th), and the low-cost production and energy prices paid off. The purchase of 11,000 mining rigs from Canaan was intriguing, and I like how the operation was funded by selling bitcoin mined.

However, he did not mention, nor was he asked about, any legal matter that could potentially bring down this particular company.

Cipher is in dispute with Luminant

Luminant, a subsidiary of Vistra Energy (VST), provides electricity to Odesa, one of the 4 mining sites of Cipher. Power is supplied through a power purchase agreement This is an excellent deal for Cipher. This provides very low-cost energy and allows Cipher to sell energy back to the grid when the price of electricity exceeds the value of bitcoins mined. Cipher management believes this gives them a significant competitive advantage over their competitors. From the research I’ve done, they’re probably right. The PPA provided an average cost per kWh of 2.7c (Slide 3 of the Earnings Call Presentation) That compared to Riot at 2.9c and Hut 8 Mining Corp (HUT) at 3.4c. Of the 16 miners I tracked, 9 published their energy costs, and these are the lowest figures of the three.

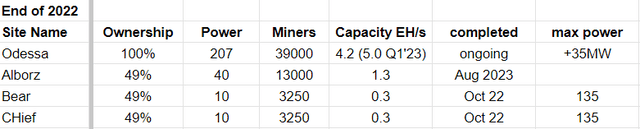

The Odessa site is vital to Cipher’s success. He has four mines; Odessa is wholly owned, and they have a joint venture in which they are minority shareholders in the other three.

Cipher Mining Sites (Q1 2023 Slides)

In the earnings call, we heard that the Odessa site (located in Texas) has continued its construction and reached 5.0 EH/s capacity, meaning that Odessa represents 84% of Cipher’s mining capacity. Cipher owns another 49% of its locations as part of a joint venture with WindHQ. In the earnings call, we heard that Cipher ordered 11,000 more miners for Odessa and expects to have them installed by Q3.

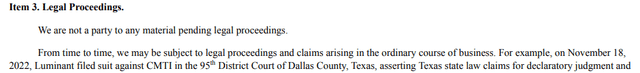

Management didn’t mention the legal dispute with Luminant in the Q1 earnings call. FY 2022 Report (P60 10K from 2022) did not describe the issue as material. In my view, that’s potentially a lot of material.

Luminant Legal Case (FY 2022 10K Notes)

In this case, Luminant is seeking repayment of $6.7 million they claim was paid to Cipher in error. Cipher said in the FY 2022 report

We strongly oppose the claims made by Luminant and we intend to vigorously contest this matter

One example from industry is the cause of my concern. Hut 8 faced a similar problem with the electricity supplier at one of its sites, supplied by Devon Energy (DVN) subsidiary Vista. (I covered this matter in my recent article (Bitcoin Miners Are Taking Off, But Where Is Hut 8 Going?)

Hutt also strongly contested the claim; Ultimately, Vista shut down the power supply!

The case is still not resolved, but the entire site remains without power, and about 8,000 mining rigs that are operating are in storage. Hutt does not expect to be able to re-energize the area and is looking for new homes for the miners (and a new PPA to provide electricity).

If Luminant cuts power, as happened with Hut, Cipher would lose 84% of its mining capacity and the PPA, the source of its competitive advantage, which is valued at $71 million on the balance sheet (Derivatives Line Items Slide 13), and it may be in the relevant field.

Luminant has not paid money due to Cipher under the PPA (page 60, item 3 10k FY 2022) which means that they take the dispute more seriously and have the right to terminate this contract.

(Page 4 Financial Year 2022 10 thousand,

The agreement also provides for certain curtailment events whereby Luminant has the right to reduce the delivered electric power in each contractual year. Subject to certain early termination exceptions, the Agreement provides for subsequent automatic annual renewal, unless either party gives the other party written notice of its intention to terminate the Agreement at least six months before the end of the current term. does not give

The risk seems overwhelming, and management hasn’t identified it as a material problem.

Having more than 80% of their mining rigs in a single site in Texas presents another issue. In December 2022, a storm damaged in texas One building and 17,000 Riot Platform mining rigs were taken offline. Riot, the market leader and operator of multiple sites, has sufficient capacity to deal with this level of disturbance; I’m not sure that’s true of ciphers.

Cipher bought 11,000 miners from Canaan.

Cipher said in the earnings call that 11,000 miners are the lowest cost and best payout conditions ever; He also said that it was the best deal he had ever heard in the industry!

In the call, we hear how the CEO took a several-week trip to Asia to build a better relationship with a miner manufacturer. He mentioned discussions with Bitmain, MicroBT and Canaan. The CEO discusses the sales pitch that was presented; Cipher believes that, as a market leader, it has superior financials and has the potential to be a leading long-term customer.

Canaan is the least well known of the three. Its Avalon mining rigs have a reputation for working well in high temperatures (useful for Texas) and are known to be reliable. it is not considered As powerful or profitable as Bitmain’s Antminer or MicroBT’s WhatsMiner. Obtaining accurate information on the mining profitability of various miners is challenging because it is a source of competitive advantage for miners and manufacturers.

As far as I know, the two real market-leading miners (in terms of capex) Riot and Marathon Digital Holdings (MARA) are not following Cipher and are buying from Canaan. They are buying from Bitmain and MicroBT. It makes me wonder if the great deal Cipher signed was something Bitmain and MicroBT were unwilling to sign. The deal could give Cipher the substandard mining performance per rig compared to the market leaders they aspire to be.

executive pay

I think many SPAC deals have lined the managers’ pockets at the expense of the investors. I have avoided several companies on this issue alone.

Tyler Page, CEO of Cipher worked before to Bitfury as Head of Business Development. bitfury Started in Holland in 2019 as a bitcoin miner; They are now an investment company and have invested in several companies in the crypto landscape. Bitfury owns 5% of Hut 8 and 81% of Cipher.

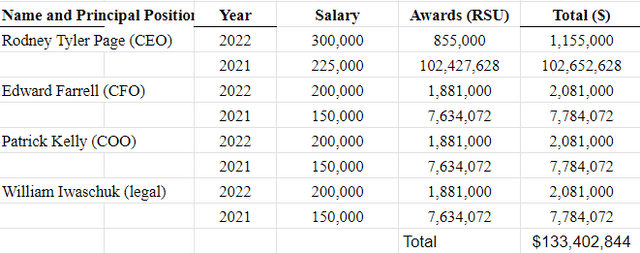

Page was at Bitfury for eight months before becoming the founding CEO of Cipher. Page received $103 million in salary and prizes in the first two years of Cipher’s operation. proxy statement Where does this information come from, explained that he needed it to stay in business. (In comparison, RIOT’s CEO received a total of $43 million over the same period.)

Payment to Officers (Proxy page 28)

The amount is significant, but most is performance-related restricted stock, so shareholders should benefit if Page gets the total amount.

Best in Class: Groupthink?

I often listen to earnings calls live; You can obtain additional information about how management answers questions by reading their prepared statements. After this call, I was convinced that the administration believes that they are already the best mining company. He said this phrase more times than I can remember. I didn’t hear any disagreement or disagreement, no one thought they were best in their category. The managers already believe they are the best bitcoin mining investment and can’t understand why the market isn’t agreeing, and the share price isn’t rising at the same rate as others.

It reminded me of a Hollywood movie in which the characters were so concerned about making money from an asteroid that they forgot it was headed for Earth.

cipher finance

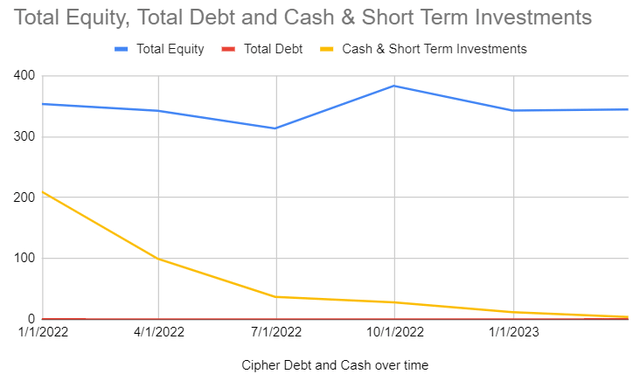

Cipher Loans and Cash Over Time (author database)

Cipher has zero debt but has now spent most of the cash raised in the SPAC transaction. In April, Cipher mined and sold 406 bitcoins to fund its operations, holding 427 bitcoins.

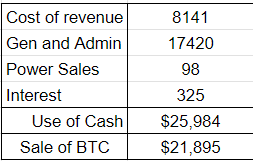

During the last quarter, Cipher reported the following cash activities.

Cash Use (Earnings Q1 2023)

It is a low-cost operation with only 28 employees (compared to 489 at RIOT). However, with a reported $3.9 million in cash and around $12 million in BTC, it has only $16 million in short-term assets, less than it could spend in Q1 2023.

Cipher had stated that it intended to continue its development and operations using the bitcoins it produces, and even if it has a large portion. atm shelf is in the prospectus ($250 million), it does not intend to issue new shares. It looks like a tight balancing act; I expect any significant disruption will force Cipher to take on debt or go to the markets.

conclusion

Cipher has rapidly increased its capacity and signed excellent agreements, making it a low-cost operator with potential sustainable cost advantages due to its PPAs.

It has increased its capacity with very few employees as compared to its peers.

Cipher is short of cash and spends the bitcoins it produces for operations, so I believe any drop in production could mean a trip to the ATM shelf registration.

The PPA with Luminant is its biggest asset and its biggest threat.

At the moment, to me, buying into Cipher seems too risky.

My next minor article will be on the Riot platform.

source: seekingalpha.com