steve jennings

Since going public, Coinbase (NASDAQ:COIN), the leading regulated exchange in the crypto space, has suffered a prolonged decline in its stock price. The day of the IPO was the company’s all-time high, and shares have basically sunk in a straight line since then.

While the company’s fundamentals leave something to be desired, the firm remains a bedrock crypto institution and household name. We believe management is taking the right steps to diversify the company’s revenue base and cut bloat, which has significantly improved the fundamental side of the equation. On price action front, technical indicators suggest that the stock is oversold and ready for a rebound.

This setup presents an attractive opportunity for income seeking investors. By employing the short put strategy, we can take advantage of this situation while minimizing risk and generating a solid chunk of income. With an extremely high probability of success, the business idea we’ll outline is not only compelling, but it’s also – we think! – The best risk-adjusted way for everyday investors to potentially profit from the risk of the crypto markets.

financial result

As we just mentioned, Coinbase has a rocky financial track record; Good to know that up front.

While the company has been able to generate tremendous revenue and profits in bull/active crypto markets, the company turns red when cash flow dries up and interest in crypto wanes:

SeekingAlpha

At its peak in Q4 2021, COIN generated approximately $1.4B in operating income, which is more than triple the Nasdaq (NDAQ) income over the same period. However, since that peak, operating results have mostly been weak.

Revenue fell 75% to $604 million from $2.4B over the next 12 months, and operating profit went deep into the red.

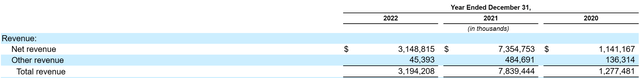

The culprit here is Coinbase’s business model, which is based mostly on transaction revenue:

10 thousand

COIN calls this “Net Revenue”. “Other revenue” is things like Coinbase One (the membership plan for COIN), Coinbase Cloud fees, interest income, custodial fees, and blockchain staking rewards.

As you can see, as the crypto bear market has taken hold, trading volume has decreased, and digital asset prices have plummeted. It proved to be a 1-2 punch in terms of revenue impact, which most recently led to operating losses.

However, Brian Armstrong and management have shown a keen awareness of this problem and have continued to move towards separating the business from a pure maker/taker fee.

Coinbase is taking serious steps for this. It is reported that the firm is considering starting a offshore futures exchangeand the company just announced the launch Base, It has its own Ethereum L2 rollup chain. These initiatives and others should begin to change Coinbase’s revenue profile in the future, to the benefit of shareholders who have been on a bumpy ride so far.

However revenue is only half of the equation. The management also keeps a close watch on the expenses incurred within the organization.

In the most recent quarter, Coinbase actually produced an operating profit for the first time since Q4 2021. With revenue still down more than 60% from the high, this recent gain is the result of management taking a serious ax to the company’s cost structure. And, as revenue has started to rebound over the past two quarters, it’s clear that the reduction in headcount and other expenses isn’t having any impact on the product’s success.

As users ourselves, we can also say that it seems like the company is moving quickly to release better products, such as the company’s recent TradingView integration into its PRO offering, and UI and UX. has been simplified/improved.

Between revenue mix strategy and cost structure agility, Coinbase has proven through recent volatility that it has tremendous operating leverage, which is an excellent quality in long-term investing.

Now that management has also “taken the hint” when it comes to profitability, it doesn’t look like costs will rise again anytime soon.

Overall, we think this reveal is a good time to delve into the original story.

Technical

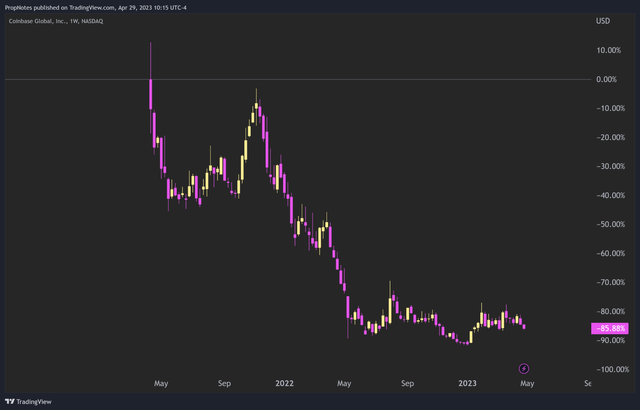

As we said at the outset, Coinbase shareholders have had a rough ride since IPO day:

trading view

Not only have stocks underperformed the market (which is obvious), but they have also underperformed the entire crypto market:

trading view

Bitcoin and Ethereum Are Really Overwhelming better In a bear market for digital assets, that may come as a surprise to some investors.

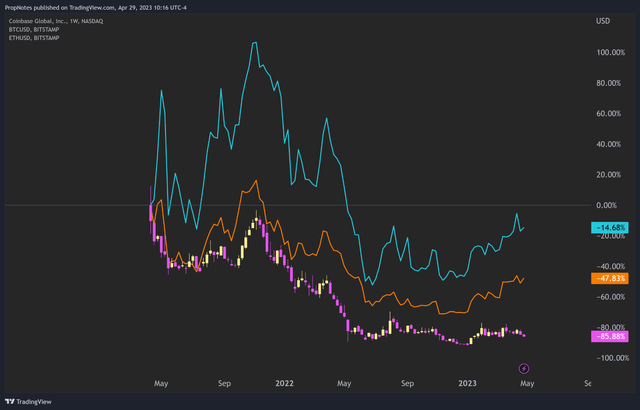

In contrast, COIN stock fared significantly better in the first three months of the year when bitcoin and ethereum caught up:

trading view

Taken together, COIN shares throughout history should be viewed as leveraged proxies of mainstream crypto assets such as bitcoin and ethereum, given how much the underlying business model relies on trading interest and fees.

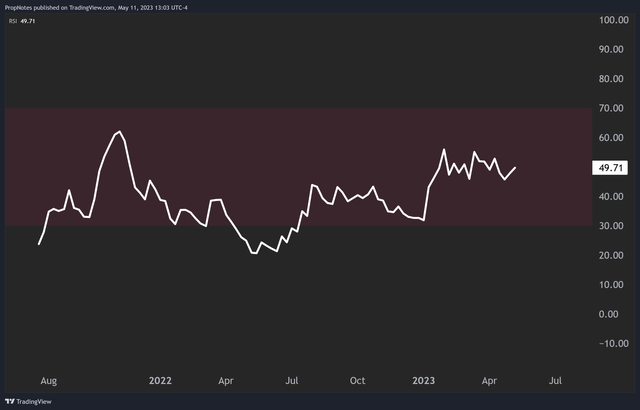

In addition to underperforming, COIN stock is also currently oversold on various time frames. The weekly RSI is showing a reading of 49, which is relatively bearish

In fact, on the weekly time-frame, COIN has never printed a price higher than 62:

trading view

This means that in Coinbase’s entire history as a public company, the stock has never been “overbought” on higher time frames. We don’t expect this to be the case forever.

Business

While we prefer the risk/reward in owning shares from these levels, COIN is an inherently volatile stock in an inherently volatile market. Buying stocks may be the right move for some volatility junkies, but for those with a more moderate risk tolerance, the best way to get into stocks is by selling out-of-the-money put options.

Expressing bullish views on oversold stocks like Coinbase, selling put options can be an effective way to generate income and hedge risk. When you sell a put option, you collect the premium upfront and agree to buy the underlying stock at the strike price if the option is exercised by the expiration date.

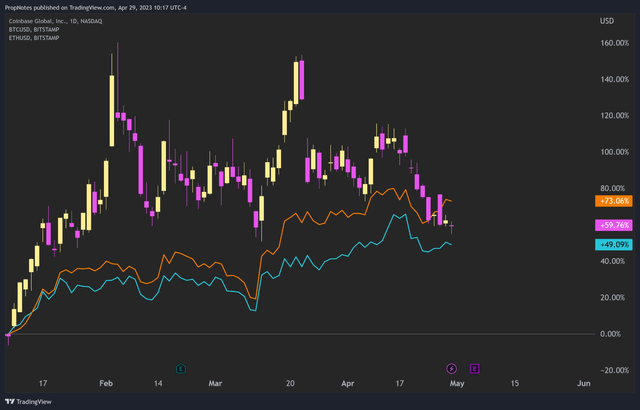

For this position, we prefer the July 21, $35 strike put.

Strike & Expiry (Trading View)

They currently pay $125 per contract, which is 3.7% cash back over the next 71 days. It’s annualized to a healthy 19% yield. Options markets also estimate that these contracts also have a 92% chance of expiring at maximum profit, which is very high.

In exchange for this income, you take on the risk of needing to buy COIN shares at $35 per share sometime between now and mid-July. $35 is a huge point of support in the stock, and it also represents a 45% discount from the current price as of writing. In other words, it’s a huge potential discount on this base company.

Overall, either earning yield or assigning shares looks like a win-win to us.

risk

While the business idea presents a high potential for success, it is important to be aware of the potential risks associated with the business. Here are some key things to consider:

trade execution: Coinbase’s ability to effectively manage its costs will be critical to improving profitability and growth. The company needs to do more with less, and if it looks like management is letting bloat slip again, it will be a negative for earnings and the stock.

permanent loss: If the stock drops to zero, these contracts will require you to buy the stock at $35 per share. The loss profile here is no different than simply holding the stock outright, and you can still exit the option position at any time, but there is a remote possibility that this could be extremely unfavorable.

competitorsCoinbase is a big player, but smaller than its biggest competitor, Binance. Coinbase has effectively cornered the US market, but expansion into other regions may be difficult given the increased competition.

regulator: This is the biggest risk of owning COIN. Gary Gensler has provided effectively zero useful or actionable information for the industry, instead regulating with blog posts and well notices. This poor approach to industry regulation has created a highly uncertain environment that could worsen or begin to materially harm COIN’s business.

technical quote: Despite the oversold condition of COIN stock, there is always a risk that the negative sentiment or downward momentum may persist longer than anticipated, affecting the success of the trade.

Summary

Ultimately, Coinbase presents an attractive opportunity for income-seeking investors who want to take advantage of the stock’s oversold status, capable management, and high operating leverage. By employing the short put strategy, we can generate income, reduce risk and take advantage of potential rebounds in the stock. While recent financial results have been less than stellar, the company’s strong brand equity and recent strategic moves have its ability to overcome current market challenges. With a high probability of success, the trading idea we’ve outlined offers a compelling way to participate in the future of COIN, while minimizing downside risk.

source: seekingalpha.com