spawns

Overview

Legendary value investor Warren Buffett has been vocal about his distaste for bitcoin. telling investors about a decade ago That it does not consider it a ‘store of value’ or a ‘reliable medium of exchange’, it has made it clear that it does not even meet the definition of money. This year they referred to it as a ‘gambling token’ Unfit for serious fundamental investors.

Nevertheless, time has proven the value of these digital currencies. While highly volatile, bitcoin and ethereum have maintained threshold levels of value while continuing to act as a medium of exchange. It’s fair to say at this point that Buffett may not be entirely right about these instruments.

While I agree with Buffett that bitcoin and digital currencies in general cannot be viewed through a traditional value lens, I think it is clear at this point that they do have some level of fundamental value if we look at them. treated as currencies.

I would note that it is especially important for us to consider cryptocurrencies as currencies. They certainly don’t own the shares; Owning cryptocurrencies does not represent a partial claim on a company’s cash flows like owning shares of stock does.

Instead, cryptocurrencies should be evaluated on the basis of their value as currencies: the extent to which they provide, and are used to exchange, value. Since we have metrics readily available for this, we can work towards establishing a fundamental valuation methodology for cryptocurrencies.

This article will outline these metrics and compare Bitcoin and Ethereum on this basis.

Currency Fundamentals for Cryptocurrencies

The value of a currency is established by the set of transactions it supports. There is an established body of theory around this in macroeconomics. The greater the ‘demand’ (total transactions) of a currency, the greater its value. At constant levels of the money supply, a higher transaction volume means a higher value for a given currency. A second-order demand effect would be countries holding some currency in reserve so that they can transact in that currency in the future.

The value of fiat currencies is then derived from both the size of a country’s economy as well as the volume of international transactions for the respective currency. The total domestic and international transaction volume makes up the aggregate demand for a given currency. A good example of this in the real world would be the large global scale of dollar-denominated energy trading, along with dollar-denominated debt; These are well understood to represent the fundamentals of the dollar’s uniquely high value.

That being said, we can establish a relative valuation for Bitcoin and Ethereum as well as a fundamental supply and demand metric.

The demand here is the level of transactions being ‘on-chain’, such as using the blockchain network for direct exchange. This metric does not take into account the secondary market demand for these two cryptocurrencies, namely crypto-to-fiat conversion. While these secondary market forces are undoubtedly a physical price driver, it goes beyond the scope of acting as a currency. In fact And this time we will not play in our fundamental analysis.

Supply here is of course the actual amount of cryptocurrency outstanding.

|

date |

btc volume |

ETH volume |

|

4/11/23 |

.385 M |

1.085 m |

|

4/12/23 |

.338 M |

1.022 m |

|

4/13/23 |

.332 M |

1.095 m |

|

4/14/23 |

.316 M |

1.166 m |

|

4/15/23 |

.276 M |

1.056 m |

|

4/16/23 |

.232 M |

.854 M |

|

4/17/23 |

.316 M |

1.012 m |

|

4/18/23 |

.313 M |

1.070 m |

|

4/19/23 |

.302 M |

1.085 m |

|

4/20/23 |

.297 M |

1.074 m |

|

4/21/23 |

.352 M |

1.010 m |

|

4/22/23 |

.355 M |

.862 M |

|

4/23/23 |

.433 M |

.868 M |

|

4/24/23 |

.360m |

.941 M |

|

4/25/23 |

.370 M |

.976 M |

|

4/26/23 |

.436 M |

.978 M |

|

4/27/23 |

.419 M |

.939 M |

|

4/28/23 |

.484 M |

.988 M |

|

4/29/23 |

.486 M |

.887 M |

|

4/30/23 |

.569 M |

.975 M |

|

5/1/23 |

.682 M |

1.102 m |

|

5/2/23 |

.458 M |

1.128 m |

|

5/3/23 |

.490 m |

1.117 m |

|

5/4/23 |

.491 M |

1.110 m |

|

5/5/23 |

.411 M |

1.209 m |

|

5/6/23 |

.601 M |

1.146 m |

|

5/7/23 |

.608 M |

1.101 m |

|

5/8/23 |

.575 M |

1.146 m |

|

5/9/23 |

.598 M |

1.127 m |

|

5/10/23 |

.672 M |

1.086 m |

|

5/11/23 |

.547 M |

1.100 m |

Click to enlarge

Source: Excel, YCharts

|

btc price |

$26,808 |

|

eth price |

$1,808.39 |

|

BTC Average Daily Volume (30 days) |

.450 M |

|

BTC Average Daily Volume in $ |

$12.07b |

|

ETH average daily volume (30 days) |

1.077 m |

|

ETH average daily volume in $ |

$1.95b |

Click to enlarge

Source: Excel, YCharts

We can see that over the past 30 days, the Bitcoin network has processed 6.2 times the transaction volume of the Ethereum network in dollar terms.

|

BTC Circulating Supply |

19.370 m |

|

ETH circulating supply |

121.340 m |

Click to enlarge

Source: Excel, YCharts

We can now divide average transaction volume (in dollars) by total supply to arrive at the ‘total transaction value per unit’ metric:

|

transaction value per unit supply btc |

$622.91 |

|

Transaction Price Per Unit Supply ETH |

$16.05 |

Click to enlarge

Source: Excel, YCharts

It paints a stark picture. Based on net supply/demand for the past month, bitcoin is currently worth 38.8 times more than Ethereum – even though it is only worth 14.82 times Ethereum.

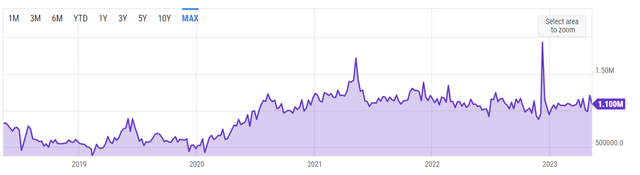

However, we should make it more relevant. Worth noting is that there has been a very significant increase in bitcoin network volume over the past month; It is currently far beyond historical norms. The boom appears to be tapering off, but it is inconclusive in which direction it will go. Furthermore, the average network activity for bitcoin appears to be lower than historical norms during 2022 and the first 2 months of 2023. This long-term, structural, trend may well continue when the short-term uptrend subsides.

YCharts

As for Ethereum, volatility was also seen in the recent trendline but with a delay of 3 months. The structural trend here appears to be opposite to that of bitcoin; Ethereum usage is fluctuating at higher levels than ever before.

YCharts

While the data is stark on a 30-day trailing basis, the longer-term technical picture reviewed here indicates that bitcoin’s network usage trend is too short-term and high-variance to constitute a reliable buy signal.

The second thing to consider is the multiples that each of these cryptocurrencies trade relative to the daily transaction volume they support.

For the monthly level of usage, however, the prices appear to be more grounded than market prices:

| Monthly Transaction Volume Per Unit Supply BTC | $18,687.41 |

| Monthly Transaction Volume Per Unit Supply ETH | $481.61 |

Click to enlarge

Thus I would venture that this is by far the best used metric going forward.

BTC also appears to be relatively cheap on this measure:

| BTC price / monthly transaction volume per unit | 1.435 |

| ETH price / monthly transaction volume per unit | 3.755 |

Click to enlarge

conclusion

While we have established a sensible way to relatively value these two cryptocurrencies, current fluctuations in bitcoin’s network usage are too variable to make the numbers reliable for an investment decision. If the huge increase in bitcoin usage proves to be consistent for the next 3 months, I would feel comfortable calling it a buy on a relative basis.

Alternatively, if the BTC trend normalizes and Ethereum’s structural trend towards higher utilization continues, I would call Ethereum a Buy.

For the time being I would be cautious and rate bitcoin holdings while network usage would be something more in line with historical norms.

source: seekingalpha.com